Kuala Lumpur, 2 February 2020 – NickMetrics has recently announced a foray into the insurance sector with an investment in Fincrew, Malaysia’s leading online auto insurance platform. With this investment in auto insurance, Fincrew is now a part of the strategic investment group and NickMetrics portfolio. Fincrew is an online auto insurance platform where potential insurance buyers get to compare policies, get quotes, and make an insurance purchasing decision online. Now, insurance buyers can compare, modify, and buy an insurance policy or multiple policies, in under 3 minutes from start to finish. NickMetrics seeks to leverage its position as a digital marketing leader, with experience in building brands and scaling up businesses organically and inorganically to help every Malaysian have access to insurance at the click of a button.

NickMetrics announced its investment in Fincrew and launched the platform in October 2020 making Fincrew a one-stop-shop for every auto and car insurance buyer’s needs. With the latest investment of approximately USD 1 million in Fincrew, insurance buyers will have access to several insurers, policies, comparison tools, new upcoming services, and a whole lot more. NickMetrics will also help the Fincrew platform target the right audiences using the best mediums, managing a content and marketing strategy, and other key-metrics critical to the insurance business.

“In early 2020, the world was struck with a pandemic which caused everything to come to a stand-still. Until then, if an insurance buyer wanted to buy insurance, then the buyer needed to visit each provider and get the details of each policy. If a payment needed to be made, it was made in-person through a policy agent. All these details increased the actual cost of insurance to the buyer,” says Nick Lai, Founder of NickMetrics. “As you can see, a buyer only has access to what’s nearby and not necessarily the best insurance for the buyer or their insurance needs. And with limited social engagements, it becomes even harder for an insurance buyer to actually visit the various providers to purchase an insurance policy.”

“If a person is looking to secure their future, then they look at various aspects such as savings, investments, protection against risk or insurance, real estate, and so on. One of the most underlooked aspects is insurance and protection against an adverse event or accident. Most people don’t anticipate a negative event because we as humans aren’t wired that way. But when a negative event does come along, it can have a serious impact on an individual’s finances, health, and belongings. With the help of insurance, people can secure their futures with only a fraction of the cost” says Jeff Yap, Director, and co-founder of a partner company Two Degrees Sdn Bhd. “In fact, most Malaysian motorists are either underinsured or uninsured altogether. The insurance market in Malaysia (and Asia) is still in its nascent stages and with the help of Fincrew, every individual will have access to insurance that best fits their needs from multiple providers and in a matter of minutes. Not only will this help develop the insurance sector, but will also contribute to the auto and financial sector with the impetus for newer insurance policies and products in a competitive market (meaning lower prices as well).”

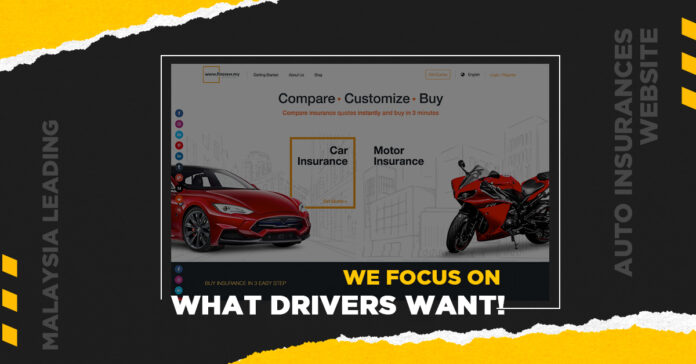

With the newly launched Fincrew website, insurance buyers have the option of buying or renewing their insurance online, evaluating different policies, paying for road tax, etc. Right now, all motor insurance and car insurance buyers can purchase an insurance policy online in 3 simple steps that take 3 minutes (apart from the time an individual research needs). First, an individual visits the Fincrew.my website. Then, the individual will select the type of insurance they want to purchase (motor or car, for example). Then an insurance buyer can compare the various policies and quotes generated in seconds. After that, the insurance buyer makes the necessary modifications to their policy in terms of length, cover, policy, etc. With a high degree of customizability, each insurance buyer can ensure that they’re getting what they need. Lastly, based on the requirements of the insurance buyer, the buyer can purchase the insurance policy online and make a payment for the same. With this process entirely online, insurance buyers save on many costs that inflate their insurance costs.