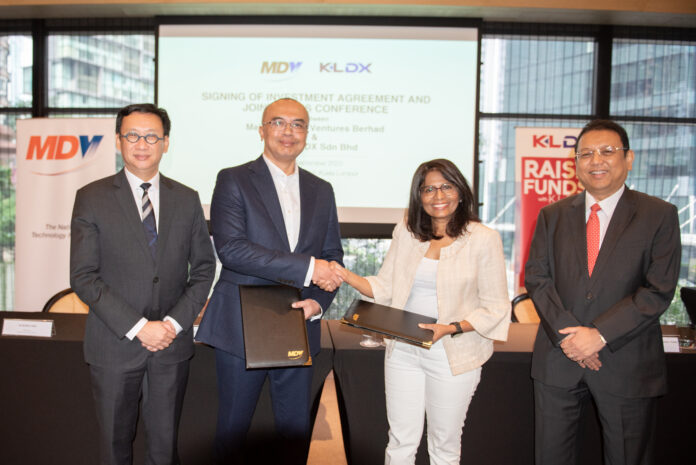

KUALA LUMPUR, 26 SEPTEMBER 2023: Malaysia Debt Ventures Berhad (MDV), a subsidiary of the Minister of Finance (Incorporated) [MOF (Inc)] and an agency under the purview of the Ministry of Science, Technology and Innovation (MOSTI), together with Kapital DX Sdn Bhd (KLDX) today signed an investment agreement for an undisclosed amount as part of KLDX’s fundraising efforts. The signing ceremony held at the RuMa Hotel & Residences was attended by MDV Chairman, YB Wong Chen; KLDX Chairman, Tan Sri Datuk Seri Nik Norzrul Thani; MDV CEO, Nizam Mohamed Nadzri; and KLDX CEO, Selvarany Rasiah.

The investment signifies MDV’s landmark venture into the Initial Exchange Offering (IEO) market and is consistent with the company’s mandate to support the technology sector through innovative financing options. The investment is part of a collaboration to also diversify MDV’s funding avenues and broaden its digital presence through participation in alternative financing platforms.

Speaking at the signing ceremony, YB Wong Chen, Chairman of MDV said: “The signing of the agreement with KLDX marks a pivotal step in MDV’s ongoing efforts to champion innovation and elevate Malaysia’s digital economy, particularly the fintech financing ecosystem. MDV also intends to leverage on the platform to finance tech projects related to the National Energy Transition Roadmap (NETR), especially in the area of Renewable Energy and Energy Efficiency. The IEO platform, bolstered by blockchain technology, introduces a new paradigm in fundraising as it offers a more efficient, cost-effective, and flexible form of fundraising for tech companies looking to scale up their business and operations. This can potentially contribute to reducing reliance on traditional financial institutions and government grants, fostering a more self-sufficient and resilient tech ecosystem.”

He added that the platform will also facilitate fundraising of Venture Capital and Venture Debt funds that will support development and growth of tech start-ups in Malaysia and the region, crucial to the nation’s vision of becoming a global tech innovation hub and strengthening its position on the digital frontier.

As the first IEO platform to be launched in Malaysia, KLDX introduces a new approach to asset ownership through digital tokens. This innovation opens up a myriad of fundraising and investment avenues, allowing digital tokens to represent a diverse array of asset classes and providing an alternative to traditional markets. The platform aims to provide investors seeking diversified, high growth investments, better access to the private market assets that are otherwise limited to institutional or high net worth investors. The platform also assists companies to realise their growth potential through a secure and efficient fundraising source that empowers issuers to raise up to RM100.0 million annually – a substantially larger issuance size compared to ECF and P2P.

Tan Sri Datuk Seri Nik Norzrul Thani, Chairman of KLDX said: “We are pleased to welcome a highly experienced and reputable tech financier in MDV as KLDX’s strategic investor and collaborator. Opportunities to collaborate with MDV in various capacities by leveraging the IEO platform also aligns perfectly with MDV and KLDX’s mission to transform the fundraising landscape for young companies that often face difficulty in securing funding from traditional financing sources and who would benefit from alternative financing sources. We are optimistic that this collaboration would help in addressing existing funding gaps and in fostering a conducive financing environment for companies, including technology companies and start-ups, to thrive. For investors we bring financial inclusion by enabling access to private market assets which are typically higher yielding and largely inaccessible to them presently. In this respect, we extend our appreciation to the Securities Commission Malaysia for its forward-thinking regulatory policies that allowed the establishment of the IEO platform.”

Selvarany Rasiah, Founder & CEO of KLDX, expressed her enthusiasm on the collaboration with MDV: “We are excited to work together with MDV and see it as a significant move towards making funding and investment opportunities more accessible in the tech and sustainability sectors. We believe that this partnership will not only provide funding opportunities but also enable transformative growth in Malaysia’s tech and sustainability sectors in keeping with Malaysia’s digital economy as well as transition to low carbon economy. Our fundraising processes align seamlessly with Malaysia’s visionary aspirations for a vibrant and dynamic digital economy. We stand at the intersection of innovation and finance, embodying the spirit of Malaysia’s forward thinking approach to economic growth in the digital age. KLDX is proud to offer a secure platform for private market investments, aiming to level the playing field for both investors and entrepreneurs.”

Nizam Mohamed Nadzri, CEO of MDV explains that as part of the agreement, MDV and KLDX intend to engage in several areas of collaboration with KLDX, including undertaking fundraising for projects identified by MDV that require substantial funding that can be syndicated on the KLDX platform; joint investments in projects originated on the KLDX platform that meet MDV’s financing criteria; developing innovative products for fundraising on the KLDX Platform; and the provision of services relating to fundraising activities on the KLDX Platform such as due diligence and monitoring. Additionally, in order to continue growing its Venture Debt financing portfolio, MDV is planning to raise funds on the KLDX Platform by establishing the first venture debt fund to be listed on an IEO platform.

“This collaboration is a significant stride towards fostering a robust digital economy in Malaysia. It allows the Company to explore new horizons in fundraising, providing MDV with expanded opportunities to grow our portfolio and continue our support for technology companies, particularly Green Economy companies, SMEs and start-ups, in a sustainable manner. I am confident that this synergy between MDV and KLDX will drive innovation, foster economic growth, and further solidify our commitment to nurturing the technology sector in Malaysia,” concluded Nizam.

In line with the Government’s Madani aspirations, with a shared vision and combined expertise, MDV and KLDX are set to usher in a new era of fundraising, one that promises to be more inclusive, efficient, and attuned to the evolving needs of the wider economy and tech industry in Malaysia.