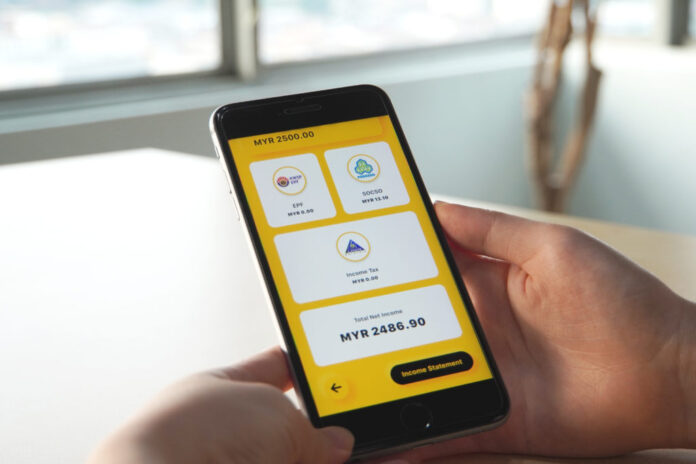

KUALA LUMPUR, 13 August 2020 – Malaysia’s own, flexi2pay app was launched recently to help players in the gig economy to manage and keep track of all financial activities while educating them about the fundamental statutory contribution. The world’s first FREE app to support self-employment was developed to simplify, automate and compute three key statutory requirements which include retirement savings by the Employees Provident Fund (EPF), social security by the Social Security Organisation (SOCSO) and income tax by the Inland Revenue Board of Malaysia (LHDN).

“At the current estimated percentage of 25.4, the gig economy in our country is growing rapidly especially after the COVID-19 outbreak as many have lost their jobs and start to operate their own businesses from home or take freelance jobs to support themselves. These people need assistance to educate and encourage them to contribute to the nation’s statutory requirements which will help our country to grow. flexi2pay will be a great addition for those who are self-employed to achieve financial freedom with a comfortable, responsible and protected lifestyle for themselves and their families,” said Victor Phang, Founder/Chief Executive Officer, flexi2pay.

“When we look at the spectrum of the gig economy, we have 4 different types of categories or profiles. The first will be the current leading industry, which is platform-driven; itencompasses workers such as e-hailer, food riders and so on which provide a on-demand for hire service. The second will be Freelancers, these individuals provide a service or skills, such as design, photography, or writing. The third category will be Self-Employed also known as small business owners, traders, e-commerce or online merchants, consultants and beauticians. Last but not least, Networkers or Agents which includes multi-level marketing, drop-shippers, insurance and property agents,” Phang added.

Phang also encouraged freelancers and self-employed workers to register their business and services with the Companies Commission of Malaysia (SSM) which would ease their operations and marketing while building credibility as legally registered organisations that are allowed to run by Malaysian law. In addition to that, the contribution to the EPF is one of the safest platforms for retirement savings as the contributors earn dividends as the year progresses. Self-employed individuals will benefit from their social security contributions when they face risks of work-related injuries which can be filed under claim from SOCSO.

flexi2pay also aims to encourage self-employed individuals who record earnings of more than RM34,000 a year to apply for CP500 to pay income tax by installment. Those who opt for a tax installment scheme will be able to use the flexi2pay app to auto calculate its monthly contribution. Contribution to income tax could also increase their financial score which means the chances of their mortgage loan or any form of loan approval will be higher. The tax contributions by income earners help the government in funding public services to the ‘rakyat’ including public schools and healthcare. This also includes the assistance provided via the Economic Stimulus Package (PRIHATIN) post-COVID-19 outbreak. The government has also launched an initiative to help the gig economy under the Economic Recovery Plan (PENJANA).

“Looking at the bigger picture, when our gig economy continues to expand and contribute to the statutory requirements, this will eventually contribute towards the country’s Gross Domestic Product (GDP),” said Phang again. flexi2pay utilises the strength of Social Media and Contents to share relevant information to educate the gig community on the importance of retirement savings, social security and income tax declaration.

There are several benefits when using flexi2pay app, part of flexi2pay initiative is to act like a “big corporate” for these self-employed members to provide them with corporate-like employment benefits. There are many benefits to this because the gig community will be able to save more in the long run. flexi2pay will be announcing their partnered merchant soon. Currently, flexi2pay is offering FREE up to RM10,000 Personal Accident Coverage for 1 year by Allianz for those who subscribe for the annual membership. Since its launch, flexi2pay has received more than 1,000 membership sign-ups with more than 12,000 Social Media followers. The app is downloadable via Google Play and App Store and available in both FREE and paid versions to suit different requirements of self-employed individuals. Phang envisioned his app to take up the Southeast Asian region within the next two years as part of his expansion plans.