Kuala Lumpur, 23 December, 2022 – The Malaysian Plastics Manufacturers Association (MPMA) appreciates the announcement by the Minister of Natural Resources, Environment and Climate Change (NRECC) on 16 December 2022 regarding the revised subsidy scheme, whereby a large portion of the electricity subsidy will be targeted for certain categories of users, thereby resulting in no increase in electrical tariff surcharge on domestic and low voltage non-domestic users for the period of January 1 to June 30, 2023 to help the ‘rakyat’. The shift of the targeted subsidy will however result in medium voltage (MV) and high voltage (HV) industrial users having to pay an electricity surcharge of 20 sen/kWh throughout the six months period from January to June in 2023.

Datuk Lim Kok Boon, MPMA’s President said “While we understand the rationale of the targeted subsidy scheme, we are also very concern about the impact of the drastic increase in electricity cost as it will not only have a negative impact on the plastics manufacturers, but the increase will have a knock-on effect that would flow to local consumers in an increase in cost of goods and services and adversely affect exports.

Electricity cost forms a large portion of the plastics manufacturing costs, ranging from 5% to 20%, depending on the type of production processes. The 20 sen/kWh electricity surcharge or approximately 44% increase in electricity tariff will translate into a net increase of between 2.2% and 8.8% in the plastics manufacturing cost. The plastics industry is very competitive, and most SME plastics manufacturers are operating at net profit margins of between 3% to 5% of their revenue. Such a drastic increase in cost will wipe out the margins of these manufacturers. Consequently, plastics manufacturers will have no alternative but to pass on part of the cost increase to the end consumers. This will adversely impact local consumers in Malaysia, and will also affect exports because the sharp spike in cost will render Malaysian plastics products less competitive in the global market”.

Datuk Lim also clarified that as the manufacturing process involves the melting/extrusion of plastics, electricity consumption is invariably high and consequently, even SME plastics companies are affected as these companies fall under the Medium Voltage category due to the power consumption level. This is contrary to the perception that SME companies are not affected by the increase in surcharge.

Datuk Lim quoted two examples – one of a typical Small Medium Enterprise (SME) plastics bag manufacturer with medium voltage E2 tariff and another larger scale plastics packaging manufacturer with the latest technology and low electricity consumption, high output machines in its plant.

Typical SME Plastics Bag Manufacturer

Average monthly output – 370,000 kgs

Average monthly electricity consumption – 410,000 kWh

Impact of increase – (RM0.20 new surcharge – RM0.037 current surcharge) x 410,000 kWh = RM66,830 per month

Large-scale Plastics Packaging Manufacturer

Average monthly output – 7,000,000 kgs

Average monthly electricity consumption – 5,850,000 kWh

Impact of increase – (RM0.20 – RM0.037) x 5,850,000 kWh = RM953,550 per month

“It is clear from the above examples that such a drastic cost increase will basically wipe-off all the profit margins of the SMEs,” added Datuk Lim.

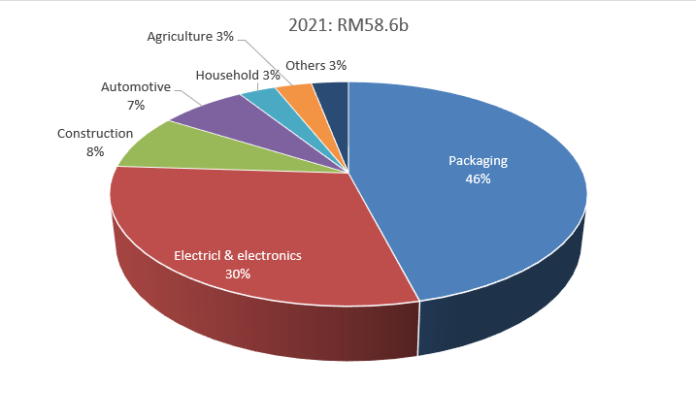

Plastics products cut across all sectors, namely food packaging, medical and pharmaceutical, consumer electronics, household wares, construction, agriculture, personal care, etc. Among all these sectors, packaging is the largest market sector for the plastics industry, which commands 46% of the total plastics products sold. Majority of the plastics packaging are used to pack food and beverages, for example, frozen meat, fresh vegetables, beverages, rice, sugar, flour, edible oil and all kind of processed food. Many of these are daily necessity items, and consumers will eventually have to bear the additional cost due to the increase in plastics packaging cost.

The plastics industry is also a major supporting industry to many other important sectors including the electrical and electronics, automotive, and packaging industries through the supply of plastic parts and components. The increase in the cost of plastic parts and components will lead to a price increase in these products as well.

“Over the last two years, plastics SMEs struggled to survive due to the Covid-19 pandemic. Businesses are just beginning to recover in 2022. However, the outlook for 2023 is increasingly gloomy. The International Monetary Fund (IMF) in their October 2022 outlook report have forecasted global growth to slow down to 2.7% in 2023 (2022: 3.2%), coupled with global inflation being forecasted to remain elevated at 6.5% (2022: 8.8%). This is expected to see a contraction in global trade, which will adversely affect Malaysia as well. The local business recovery process is therefore very challenging as apart from the increasingly difficult global market situation, manufacturers in Malaysia face various types of cost increases due to supply chain interruptions, rising raw material cost, minimum wage increase and higher financial interest rates. The prolonged issue of labour shortage had also limited their ability to expand their businesses. As a result, it is almost impossible for the plastics manufacturers to fully absorb the drastic increase in the electricity cost.”

“We would like to appeal to the Government for a more gradual surcharge rate to ease some of the cost burdens on these industrial users and the consumers,” said Datuk Lim.

Industry Background

There are currently about 1,200 plastics manufacturing companies in Malaysia, employing about 150,000 workers. About 90% of the companies are SMEs, based on the 2014 SME Definition. The plastics industry registered a total sales turnover of RM58.6 billion in 2021, of which 27% or RM16 billion production was exported.