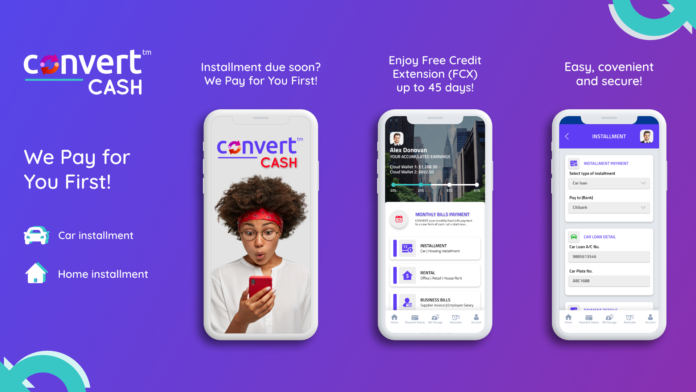

Malaysia, 5 March 2021 – With the Covid-19 pandemic, many are looking to stretch their cash reserves and convertCASH, a revolutionary fintech platform is helping its users to do exactly that. The fast-growing, innovative fintech solution allows users to pay monthly car and home installments up to 45 days without any interest.

convertCASH which was launched in November 2020 aims to help the community with cash flow issues in handling their monthly installment. convertCASH is targeting to achieve one million registered car users in Malaysia and 200 million registered car users globally.

“convertCASH rethinks the way of your monthly car/home installment & adding additional value on top of user’s monthly car and home fixed installments,” said Co-Founder of convertCASH, Jason Bak. Co-Founder of convertCASH, Jason Bak.

Co-Founder of convertCASH, Jason Bak.

“Monthly fixed bills commitment and all these have become stressful to everyone. convertCASH “Pay for you first” benefits to help everyone to ease their monthly burden. Users can rely on convertCASH even if they do not have sufficient cash in the bank to settle their monthly car / home installment,” said Jason.

“It is interest free, no borrowing with instant approval. We only require the users to have credit card as security while using convertCASH’s “Pay for you First” benefit. They can then pay back to the credit card up to 45 days later without any interest charge,” added Jason.

Jason added that traditionally, if a car and/or homeowner do not have enough cash for that month, they will have to borrow money from friends or family but with convertCASH, they don’t need to apply for any loan or borrowing from anyone. They just need to fill in the details of the recipient in the convertCASH App and the installment will be made within one working day.

“No application needed, no loan, no borrowing,” enthused Jason.

It Is just 3 simple steps for users to start using convertCASH.

Step 1: Download the App,

Step 2: Register with the users’ email and mobile phone.

Step 3: Start utilizing convertCASH “We pay for you first” features

“The maximum transaction amount that can be made via convertCASH is $5000 USD (RM20,000.00). To date, we have an average amount of $123786 USD (RM500,000) transacted via convertCASH platform. Every transaction means a lot to us. It means that we have successfully helped people to ease their problem.” Jason added.

Using convertCASH gives the users peace of mind and takes the stress out of having to meet those monthly fixed car and home installments. And with the convertCASH App, users can make payments on the go – wherever and whenever.

Users seamlessly initiate payment within minutes all from one convertCASH, Mobile App. With the platform’s instant approval and zero-risk approach, they can enjoy free credit extension to help ease their fixed monthly financial burdens.

“With our incomparable borderless digital economy strategy, our objective is to help more companies and users change their lives with the convergence of the digital and traditional economies.”

As an installment payment extension as a service (PXAAS) and global cash reward eco-system platform, convertCASH embraces the Steve Jobs’ philosophy of “Create a product to change people’s lives.”

“Our ‘We Pay for You First’ approach brings instant added value and will be a significant disruptor in the Fintech space. Our team is well-prepared to realize and embrace the fullest potential of the emerging global digital economy,” said Jason.

Jason added: “We believe convertCASH is the first to merge traditional business with the digital economy and take the principles enjoyed by the likes of Uber and Airbnb into new territory.”

Headquartered in Singapore, convertCASH is experiencing rapid growth across Malaysia, Indonesia, Australia and the ASEAN region. The platform plans to expand to Hong Kong, Thailand, Vietnam and Philippines in the second quarter of the year and to Japan, Korea, China in 2022.

The app is available on IOS, Android and Huawei.

For more information about convertCASH: https://convert-cash.com/.